If you’re looking for a more relevant credit score, you have several options. Is there any other way to get my credit score? This can result in an even lower credit score from these lenders. Similarly, if you were to apply for a car loan from an auto lender, it will use its own score designed to predict the likelihood of you defaulting on an auto loan. For example, if you were applying for a mortgage with a home loan company, it would probably use a score that is specifically developed for mortgage loans. It’s also important to note that, each time you apply for a specific kind of loan with an individualized lender, it will likely also use its own customized formula.

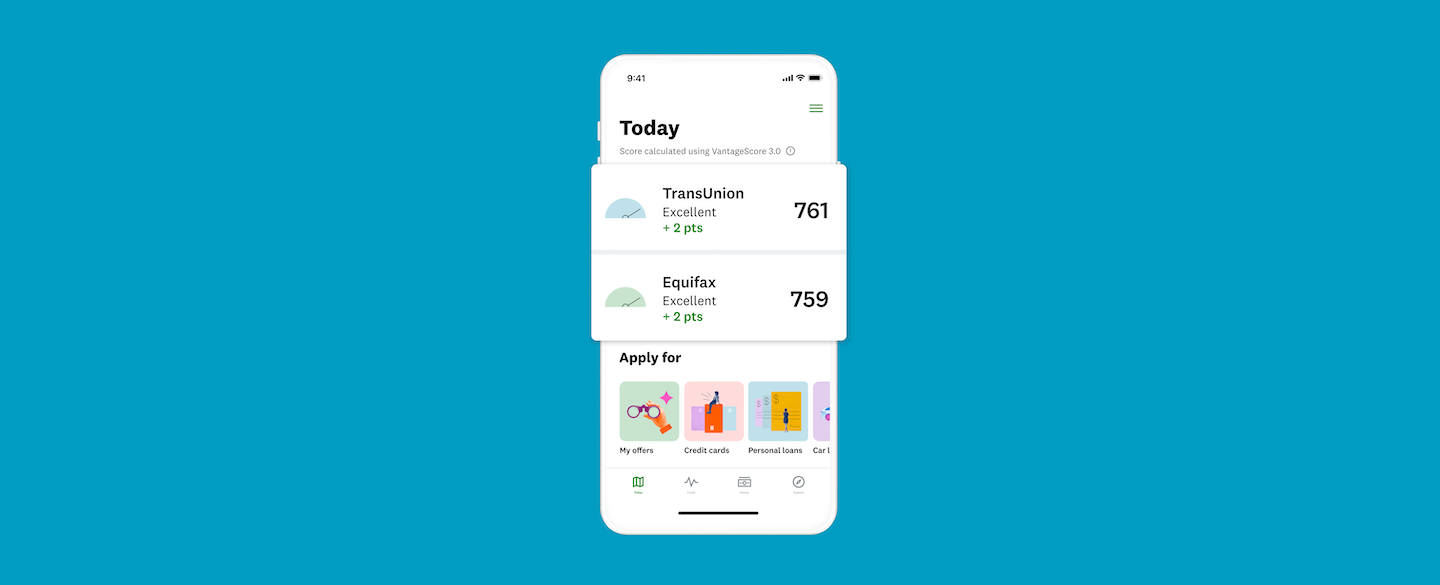

As mentioned, this number will likely be lower than the score you see on Credit Karma, but will fall within the same general range. Most financial institutions use a FICO scoring model to measure consumers’ credit scores. You can also get a report with a thin credit history through this model, which is super-helpful for those seeking to build their credit from nothing. The credit service is usually within range and a good indicator of your overall credit wellness. The atypical scoring model used by Credit Karma, coupled with the absence of information from Experian, the third of the three major credit reporting agencies, tends to make Credit Karma scores differ from scores pulled by other companies and financial institutions. The FICO scoring model is by far the most widely used credit score among financial institutions and lenders across the country, with 90% of lenders using this score to net potential borrowers. While this type of credit score is gaining popularity among lenders, you may not recognize it-and for good reason. The online credit company uses information from two of the three major credit reporting agencies, TransUnion and Equifax, to give you a VantageScore 3.0. How does Credit Karma calculate my score? While this may seem like a breach of privacy, it’s no different than the way much larger online platforms you likely use, including Google and Facebook, earn a profit. For example, if your credit is excellent and you’re looking for a home loan, you’ll probably find loads of ads from mortgage companies. As you learn your way around the site and start to frequent it more often, you’ll see ads that are geared toward your specific financial situation. Credit Karma also offers lots of credit advice, customizable loan calculators and reviews on financial products of all kinds.Ĭredit Karma earns its profit through targeted ads. Scores are updated once a week, and the company only performs a “soft inquiry” on your credit to get the necessary information.This means your score is never impacted by it checking your credit on your behalf.

:max_bytes(150000):strip_icc()/1-5bfc391846e0fb00265fa67e.jpg)

You’ll need to sign up for the service and share some sensitive information, like your Social Security number and your financial goals, but you won’t be asked for any credit card numbers or account information. To that end, the site allows you to check your credit whenever you’d like without paying any fees-a privilege that can cost you about $20 a month from its competitors.

#Credit karma score vs actual score free#

What is Credit Karma?Ĭredit Karma is an online credit service that operates under the principle that everyone is entitled to a free and honest credit score. We have answers to all your questions about Credit Karma. How accurate are the credit scores it shares? Is there anything I need to be aware of before signing up for this service?Ī: Credit Karma is a legitimate company however, for a variety of reasons, its scores may vary greatly from the number your lender will share with you when it checks your credit. Q: I’m trying to increase my credit score ahead of applying for a large loan, so I’m considering signing up for Credit Karma to track my score.

0 kommentar(er)

0 kommentar(er)